For folks who have high expense that they’re not able to pay, case of bankruptcy is actually a procedure that will help them score a brand new start. Most individual bills, and additionally handmade cards, medical expense, and you will financing, are released as a result of case of bankruptcy. Since process is performed, this type of expenses would-be forgiven, plus the borrower will no longer be required to shell out what is actually due. Although not, there are certain type of debts that simply cannot become got rid of. This type of costs, which happen to be called low-dischargeable debts, remain toward debtor even after new personal bankruptcy techniques could have been done. You will need to know how these types of expenses will feel addressed through the a bankruptcy circumstances.

Examples of Low-Dischargeable Costs

Boy help and you can alimony payments – Debts that will be categorized due to the fact “home-based assistance loans” will remain owed, while the quantity owed need to be paid-in complete, no matter what somebody’s financial situation. Attract will accrue into the balance due, and one lingering repayments that have been purchased of the a legal need remain repaid.

Taxation due toward Internal revenue service or a state otherwise state government – Straight back taxation usually can not be discharged, and they will are still due immediately after completing brand new case of bankruptcy process. However, there are some cases where government taxation bills may be discharged provided specific conditions was found. Taxation bills that will be over three-years dated in the big date a guy data files to possess case of bankruptcy are released, provided anyone possess registered most of the called for tax returns for the past number of years and will continue to document tax returns and shell out taxation which can be owed throughout their case of bankruptcy circumstances.

College loans – Federal training money, together with personal financing backed by the federal government, are generally low-dischargeable. Yet not, bankruptcy enables you to reconstitute this new payment agenda otherwise lose the total amount that’s owed.

Certain kinds of compensation for injuries judgments – Bills as a result of injury claims that have been associated with an excellent man or woman’s procedure regarding a motor vehicle when you’re under the influence of alcohol otherwise medication are usually low-dischargeable.

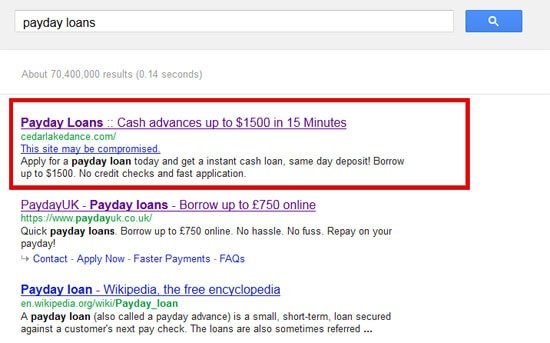

Bills obtain on account of fraudulent pastime – Bills that were acquired as a result of untrue symbolization are typically low-dischargeable. These are typically deluxe merchandise or properties totaling more $500 bought within 3 months just before declaring bankruptcy proceeding otherwise dollars advances of more than $750 received within 70 months before filing.

Unlawful penalties and fees and restitution commands – Fees and penalties, charge, or penalties bought by a court adopting the a belief having a criminal offenses generally should be paid and cannot become removed using personal bankruptcy.

Dealing with Non-Dischargeable Debts Throughout Bankruptcy

Whenever you are case of bankruptcy may treat particular bills, non-dischargeable expense must still be paid considering their conditions. However, according to particular bankruptcy proceeding recorded, these types of expenses could be managed in different ways. From inside the a chapter eight personal bankruptcy, most other costs may be discharged, which will take back more funds that any particular one are able to use to put to your their low-dischargeable costs no credit check installment loans Montreal. Meanwhile, brand new terms of non-dischargeable costs tends to be renegotiated, making certain men should be able to generate reasonable costs and you will pay-off what is actually due.

When you look at the a section thirteen case of bankruptcy, numerous type of debts is generally utilized in a beneficial debtor’s fees plan. And additionally and then make repayments towards certain dischargeable debts, a repayment plan ounts towards low-dischargeable debts to get paid off in addition to ongoing costs. It will help a guy catch up on these expense, get rid of other types of expense, and keep maintaining monetary balances immediately after its fees plan might have been completed.

Get in touch with Our very own The fresh new Braunfels Bankruptcy proceeding Attorneys

Case of bankruptcy is an approach to address several form of debts and just have another start. Yet not, it is vital to learn just what version of debts can and should not end up being released. When you yourself have questions regarding exactly how different varieties of loans commonly feel treated via your personal bankruptcy instance, the brand new experienced Boerne bankruptcy attorneys from the Law offices out-of Possibility Meters. McGhee also provide suggestions for what procedures you ought to capture second. Call us within 210-342-3400 to set up a no cost appointment now.